Recently frontends such as PeakD have added or starting to add a new metric next to the reputation score on profile pages, called the Krampus Co-Efficient Ratio (KE Ratio). For those who live under the rock, it is just the following:

ke = (author_rewards + curation_rewards) / staked_hive

That looks simple, however keep this equation in mind while reading while we look at all the issues.

KE does not take other rewards into consideration

This is my biggest issue. There are many types of rewards on Hive, content rewards is only one of them being considered. This metric does not take witness and staking rewards into account.

As of writing this, the KE ratio of this account is 0.16:

Author: 2,350.905 HIVE

Curation: 2,232.936 HIVE

Staked: 28,864.007 HIVE

That sounds great until you find out that most of my stake are from witness rewards (and to some extent staking rewards). The only time I staked any meaningful amount was during the day before the hostile takeover on the previous chain

here, and 2/13 of it were unstaked before Hive was created as a reaction to the hostile takeover.

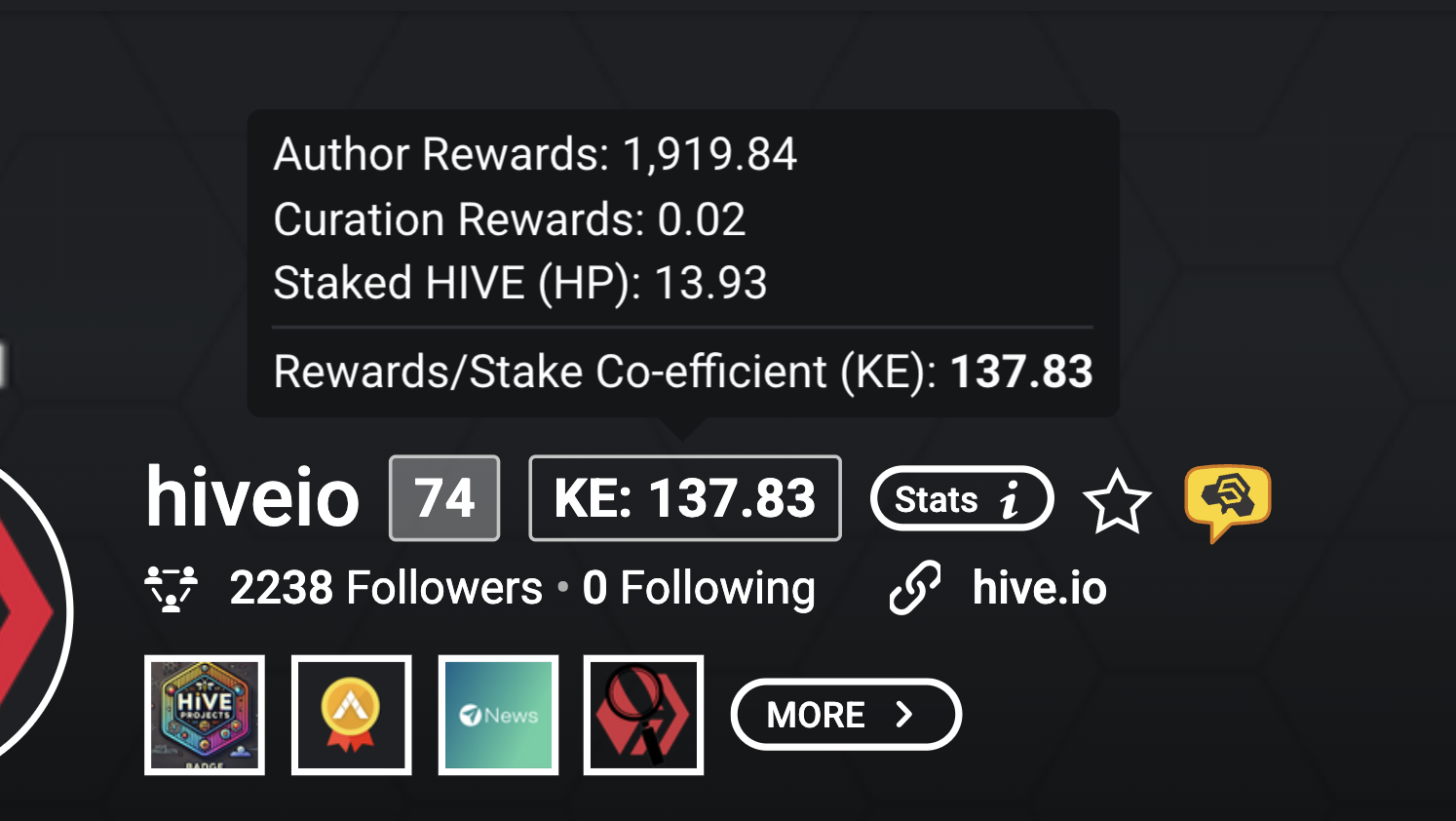

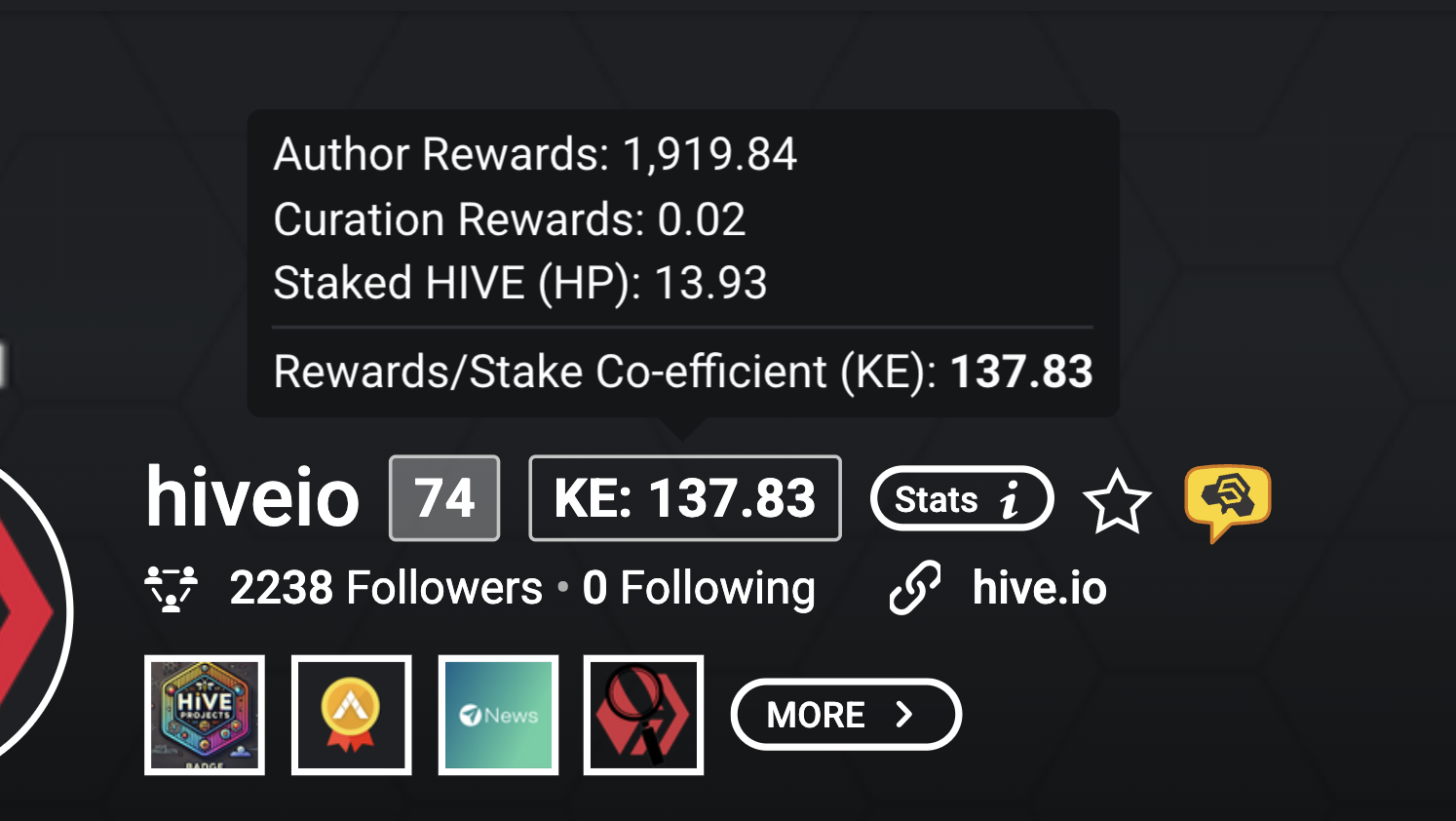

Another example is my project account

@aioha which only received posting rewards and never staked or unstaked anything. Its KE ratio is 0.97, most would expect an account with this behaviour to be exactly 1. The 0.03 is staking rewards unaccounted for.

Easy to game

Another reward that this number does not take into account are beneficiary rewards. A new account can easily have an artificially low KE ratio by having a separate account for receiving post rewards and the user could do anything they want with it without affecting the metric on both accounts.

This cannot be done on the (also flawed) account reputation score.

Meaningless and harmful without context

There are many valid reasons why earned rewards would leave an account. Just to list a few:

- Depositing assets to VSC to provide liquidity or consensus stake

- Buying other Hive assets (i.e. NFTs)

- Spending it to earn rewards from @distriator if you're lucky to live in a handful of regions in the world that accept crypto

- Former investor cashing out on stake they initially purchased from exchanges which may include curation rewards earned, whom may or may not post

- Selling rewards before Hive was created, which was a completely different coin that had nothing to do with Hive.

Performing any actions above would cause someone's KE ratio to be inflated and it is very easy for a curator to overlook them, leading to unfair stake shaming.

Stake shaming

Using this metric may ultimately be counterproductive of what we are trying to achieve. It is essentially telling or being told what you should or should not do with your rewards.

This may undermine the concept of ownership as it makes existing stakeholders feel uncomfortable of what they do or vote with their stake. The fear of being canceled (knowing this being a social media platform) could discourage many from participating in Hive governance and make them leave the network entirely.

Why are we even paying out rewards?

Instead of thinking what recipients do with their rewards, we should think about why are we paying out the rewards in the first place.

Hive currently provides the following rewards from creation of new coins, according to the

README:

- 65% of inflation to authors/curators.

- 15% of inflation to stakeholders.

- 10% of inflation to block producers.

- 10% of inflation to Hive Fund.

Not listed above are conversions (largely goes to

market makers) and HBD staking rewards (goes to HBD holders aka stakeholders). None of them are authors nor curators.

Alternatively, the above can be seen as:

- 32.5% to authors

- 47.5% to HIVE stakers

- 32.5% (68.42% of all staking rewards) for curators

- 15% (31.58% of all staking rewards) for holders of staked HIVE

- 10% to witnesses

- 10% to DHF

- Additional variable inflation or deflation to market makers and HBD stakers

With a small percentage of author rewards from

@buildawhale burn posts sent to

@buildawhale and rewards from

@buildawhale going to

@buildawhale which is a market maker and returns funds to the DHF, the actual author rewards is smaller than 32.5%.

The relevant question here is should we continue to pay 32.5% of HIVE inflation to authors. I see author rewards as an incentive to attract users to post original and high quality content on the blockchain, the same way as DeFi protocols paying out governance tokens to attract liquidity to their platform. Flagship protocols such as Uniswap and Aave have successfully done so during their early days using this mechanism and retained most of their TVL today without liquidity mining rewards, with some others having varying levels of success as well.

If HIVE author rewards have provably failed at this, I would fully support

removing the existing content rewards pool entirely and rethink another paradigm for incentivisation.

Accountability

Considering that 32.5% of HIVE inflation goes to authors which is around a few thousand users, compared to 20% of inflation going to witnesses (

115 accounts as of March 2025) and DHF recipients (likely less than 200 accounts including

@valueplan recipients which I think must be scrutinised heavily). That is around 10x of number of accounts earning from a pool that is only 62.5% larger than the others. It makes witnesses and DHF recipients the low hanging fruit that needs to be held accountable more than regular authors. Again, something any simple number here fails to show who are the real extractors.

Ultimately this would be up to HIVE stakers that earn 47.5% of all HIVE inflation to use their votes. However, there is one change we could make to improve the governance process.

Ability to veto DHF proposals

This is a well-known proposed change that exists since the existence of DHF and it should be implemented before the return proposal expires on 31 December 2029. Recreating the identical return proposal today would cost $3,730 HBD. The development cost of this feature may only be slightly more than this (correct me if I underestimated) but it provides greater control for stakeholders to vote against specific proposals they disapprove.

As for wording, I would not call this a downvote, I prefer the words veto, no vote or disapprove (approve is the field name in update_proposal_votes operation currently).

For transparency purposes, I will leave my witness stats here as it was not included in my

previous witness update log.

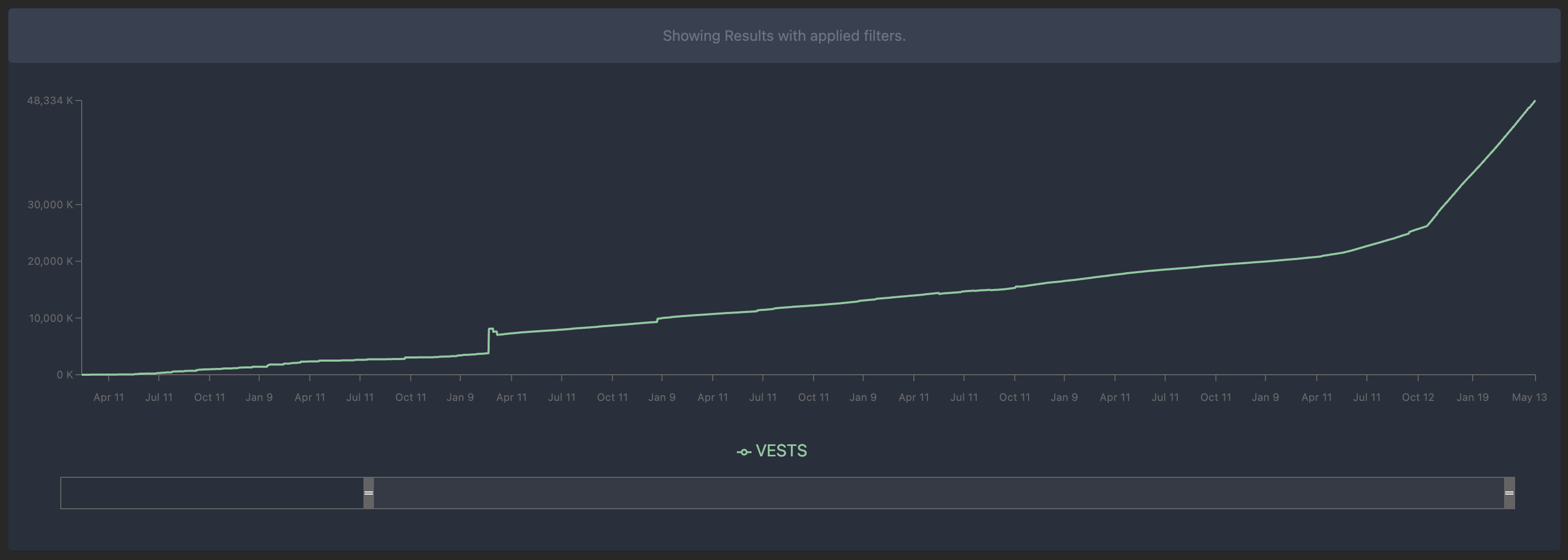

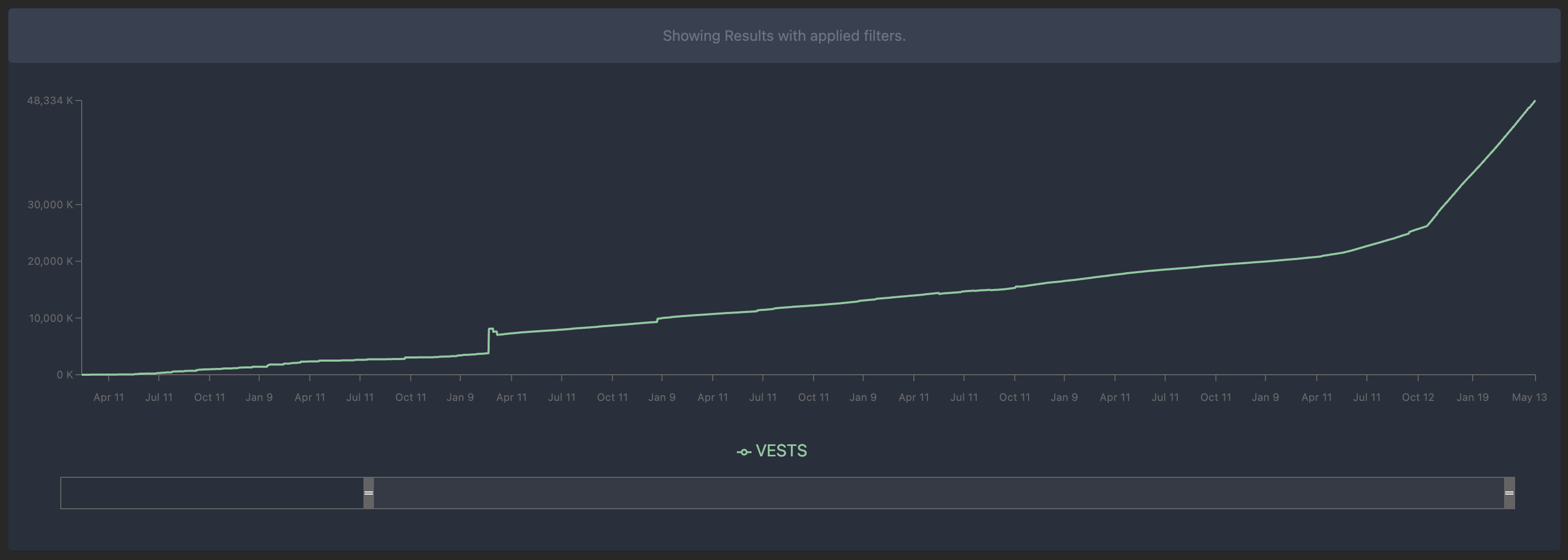

Witness performance

Current rank: 27th

Votes: 63,198 MVests

Voter count: 235

Producer rewards (7 days): 427.266 staked HIVE

Producer rewards (30 days): 1,835.696 staked HIVE

Missed blocks (all-time): 42