So I'm currently thinking another eight years to FULL retirement...

I'm quite happy with my current status which I guess we can call semi-retired, I no longer have to work full-time, although that does require a bit of luck (crypto doing OK, passive income being maintained, actually staying in part-time employment).

However I'm now wondering what I can accumulate across my basic pension schemes...

I've got seven options really....

(NB I already have a teachers pension, that kicks in at 60 years of age which is a very healthy base already, AND what should be a full state pension.

- House 1 = £400 a month after fees/ expenses and maintenance. I will in all likelihood be moving to London soon, which means house 1 which i'm currently living in becomes an income source, only after I've paid of the remaining 4.5 years of the mortgage, but that's really not that far off!

- Private pension contributions - these are to be funded by my own contributions.

- Salary contributions to my work pension, these are done automatically.

- HIVE passive-ish income...?

- Other crypto...?

- My current main blog which earns me a passive-ish income.

- Another Passive-ish income idea... ? (not really sure what this would be!?!)

House 1....

Honestly, houses are pretty poor Vests as rentals, but one always needs an emergency one spare to move back into if the worst comes to the worse. And it's capital to be drawn down if necessary.... £200K over 30 years = £7K a year, more actually if you factor in interest if i sold it, probably nearer £8-9K easy a year, worth holding on to.

Private Pensions contributions...

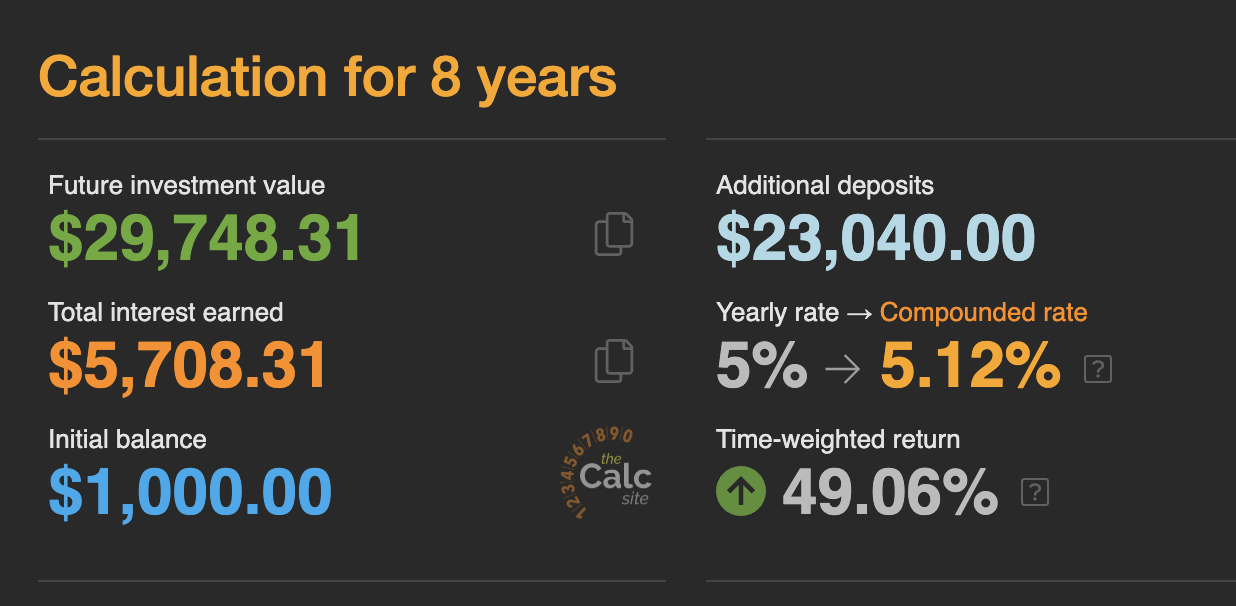

I'm gonna aim low and try and put £200 into this every month, this is basically my VEST in stocks in shares, part of... and by the magic of the UK tax man that £200 becomes magically £240 a month.

That's £30K by the time I'm 60 in the pot...

NB what a difference two years make... after 10 years it'd be £38K!

Regular employer pension

I've estimated my employer pays in around £150 a month, which isn't bad for just 2 days a week, at the same rate as the above, that'll be £19K after 8 years.

Hive passive ish income...

Here is where it gets interesting....

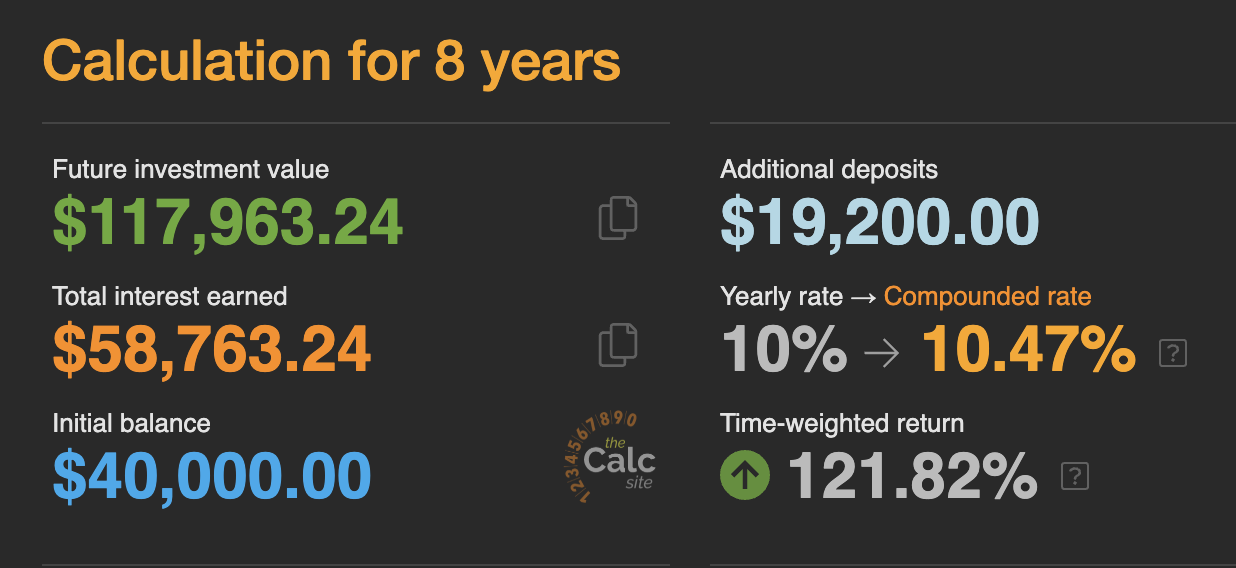

Granted my starting point is much higher already at $40K but with just $200 put in a month (NB that means I could extract more than half!) then my net result at 10% per annum compounded is.... $117 000.

That's the thing about high interest!

Granted there are a lot of moving parts, but same with the fiat world!

Other crypto....

Well I don't plan on cashing out more than 25% on the way up (hopefully), so I dunno let's say my crypto will be worth £50K - pick a number, any number! NB that assumes almost no increase in value.

That small valuation also gives me a little more flexibility to draw down some in the next eight years.

Current main blog...

The earnings have declined recently but I am soon to try and sort it. I think by the time it earns me less than I don't know £3K a year I'd jack it in, way to go to get down there yet, it's something of a passion project, and for £3K a year I'd be happy to give half a day a week to it.

Let's call it £3K a year. I might have to round that down to £0 as the entire set of qualifications I work to could well be gone by then (it is mooted) and changing everything anew might be too much effort...

A new passive project....

No idea!

TOTALS....

- HOUSE - £200k = £7K a year until death

- Private pension - £30K = £4K a year until state pension

- Salary pension - £19K = I'd save this until 65.

- Hive Passive-ish income = £80K - I'd be happy to draw down £3K a year until 68 at this point.

- Other crypto - ??? Let's guesstimate £3K a year draw down!

- Current main blog - Let's be REALLY pessimistic and call this £1K

- Other project - let's call this £1K.

So by 60 that is.... £19 a year until I hit State Pension age, and that's after my TPS money and any money I'd earn from a regular job.

So £30K a year with no housing costs, that's a pretty cushy retirement methinks, and I'll probably still be doing some form of paid work at that point too!!!