This is another financial topic that is misunderstood. It is a conclusion that I drew based upon observing the viewpoint of people over the years.

It appears that most thing inflation is bad and deflation is good.

Of course, we are using inflation and deflation with regards to price, not money supply. Milton Friedman summarized what the traditional view of inflation (and deflation) is. What is ironic is that we use the term properly when it comes to crypto.

It is not uncommon to ask what the inflation rate of a currency is. Nowhere in that question is that any relevance to price. Instead, it is the annual emission rate of a coin or token. Yet somehow, these same people will using the terminology to apply to prices when it comes to the economy.

That said, even using the contemporary idea, is inflation bad? On the other side of the equation, is deflation good?

We will dig into these concepts in this article.

Myth: Inflation Bad, Deflation Good

As we can see by the title, the idea is mythology. Like many things regarding money, economics, and finance, the reality lies in the nuances. Few take the time to work through the impact even a single layer, let alone 3 or 4.

Let us look at the basic assumption: inflation means prices go up, resulting in a decreasing of purchasing power.

This is a rather simply concept that everyone can grasp. Who likes to see the prices of eggs going up? Or gasoline? Or clothing?

On a larger scale, who likes to see the price of housing going up? Nobody!

Oops. Here is where we run into our first challenge. This is not true. Many people love when their price of their homes go up. After all, who wants to sell a property and have to bring a check to closing? Do you want the value of your real estate to go down?

So homeowners are happy when prices go up. Ironic that many of the people who complain about rising prices actually own property.

What about the stock market? Or crypto? Are you happy when prices go down? Aren't these assets on sale?

My observation is that people are sickened when markets collapse. They lose their cookies, often believing that prices should only go up.

Wait a second: I thought rising prices (inflation) was bad. How come people get upset.

Of course, they aren't referring to those prices. They do not want the value of their assets to decline, only the cost of everyday products.

Deflationary Foolishness

Before digging into deflation, there is one kind that, historically, has been beneficial. This is the deflation as a result of technological advancement. Unfortunately, this is often something that gets overlooked since it is not typically in the government data. After all, free does not register. Yet when this occurs, standards of living go up.

Industries affected by this tend to become obsolete. Technology creates a replacement which pushes companies into bankruptcy. Blockbuster Video is an example.

Getting back to prices, why is it bad when prices of things such as food and clothing start to decline? The answer lies in the economic impact.

Economists tell us that, when prices are declining, purchases are pushed off. This is another fallacy the economics profession tells us. If that was the case, why have semiconductors, something that declines at roughly a 50% rate seen a CAGR of 13% over the last half decade?

If this is not the problem, what is the issue?

It all starts with declining revenues. What happens when revenues decline? Most often, profits tighten. Obviously, costs of raw materials can drop, helping to maintain the margin. The problem here is prices rarely fall in unison. Some input costs go down, some up, a few remain the same.

As mentioned in my last article, the supply/demand equation has many components.

Then we have the number one expense for most companies: labor. Here is where deflation is a killer. If revenues start to decline, margins are apt to squeeze due to the fact labor, initially, remains the same.

We never see conversations where an employee walks in for an annual review and gets a spectacular review, then a 10% pay cut. If all is being squeezed, companies look to the number 1 cost, payroll.

The net result is layoffs.

Investment

A final piece of the puzzle is investment. People do not want to invest in a decline. Investors are not anxious to rush into those areas where contraction is taking place. Without investment, economies do not growth. They become stagnant, causing standards of living to be affected.

This is exemplified by Japan over the last 35 years. The country is on its 4th lost decade. This occurred in spite of more than 70 efforts at quantitative easting, i.e stimulus. Much of this is driven by demographics that are seeing a decline in population.

Here is where a couple major problems arise. To start, older people tend not to invest since they are at a stage in life where savings are used to live in. The second issue is that an older population requires more social services (cost) without providing increased economic productivity.

The net result of this is a lack of investment into the country. We see how other nations surpassed Japan for foreign investment dollars.

Most in the West do not pay attention to this. For those areas, the last deflationary period was the Great Depression. This was not a favorable time for people.

When prices are collapsing, investors cannot get a return on their money. To compound matters, default is often the case since revenue streams fail to cover the ongoing obligations. Once this happens, we see a contraction in the money supply due to default.

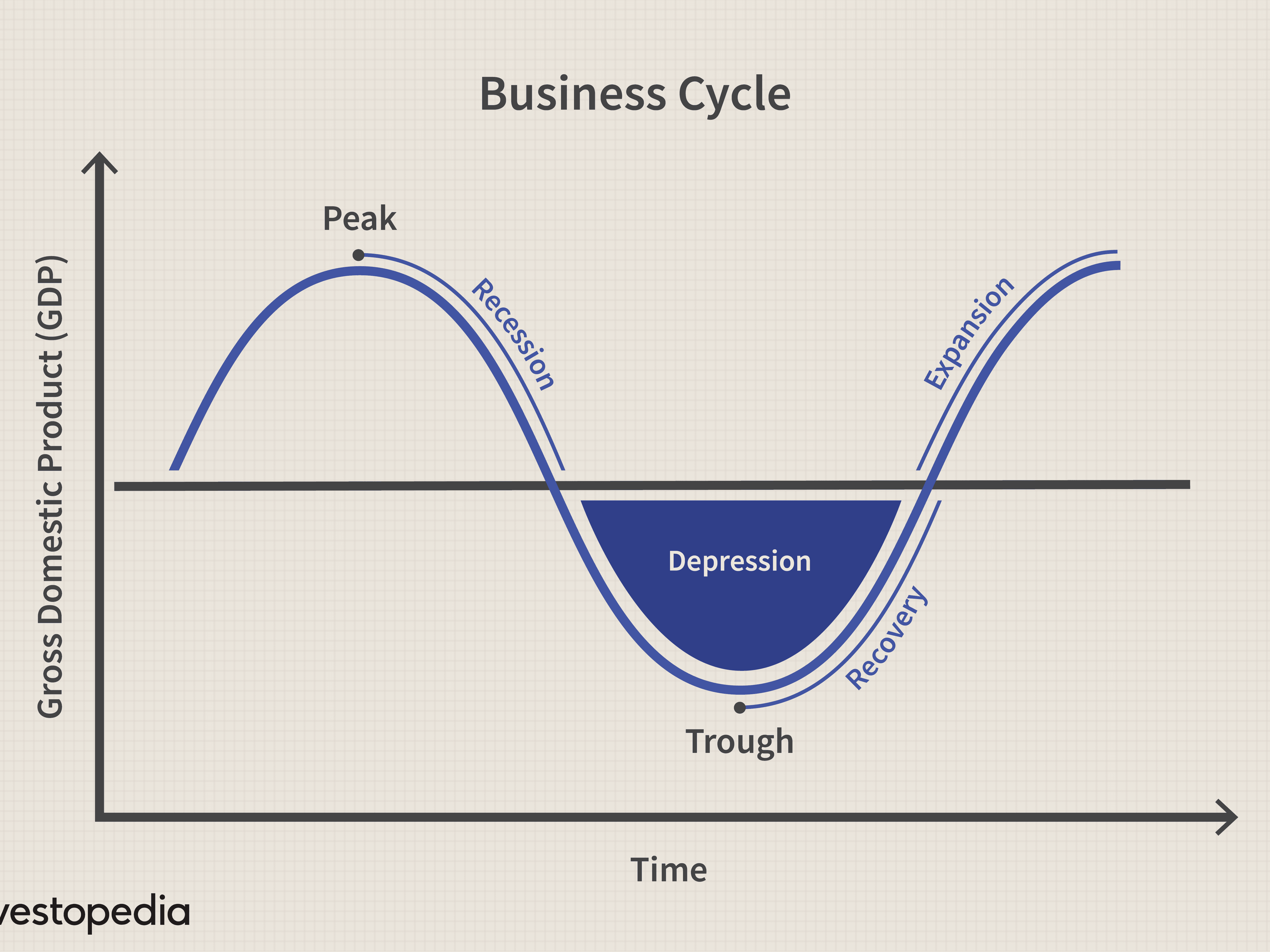

[Source](https://bilag.xxl.no/read/draw-and-label-the-business-cycle.html)

[Source](https://bilag.xxl.no/read/draw-and-label-the-business-cycle.html)

The Business Cycle

The above image is one of the business cycle. This is something that gets ignored by most. Some even claim that it no longer exists.

Believing the business cycle can be changed makes one a communist. Or a gold bug. Or a central banker. All think they can magically change the business cycle simply by implementing some long disproven theory.

The reality is the downside of the business cycle creates deflation. As we can see, this is called a recession. During that period, prices drop. This leads to job loss, defaults, and bankruptcies. It is not a fun time.

As we move up from the trough, expansion occurs. Here is when prices go up. Labor is able to ask for, and receive, more money. Companies can charge more for their products. Discretionary spending excels. Investors get off the sidelines, funding start ups and other businesses that drive the economy.

Everything goes well until the next peak, when the process repeats itself.

Unfortunately, a deflationary spiral can be fatal. Few countries enter it but when they do, it is horrific. Japan suffered a great deal although that stopped short of a spiral. One country could be facing that and it is China.

One sign might be the youth unemployment. In a country with an aging population, that is almost 16%. As the CPI turns negative, the economic strain is likely to cause unrest.

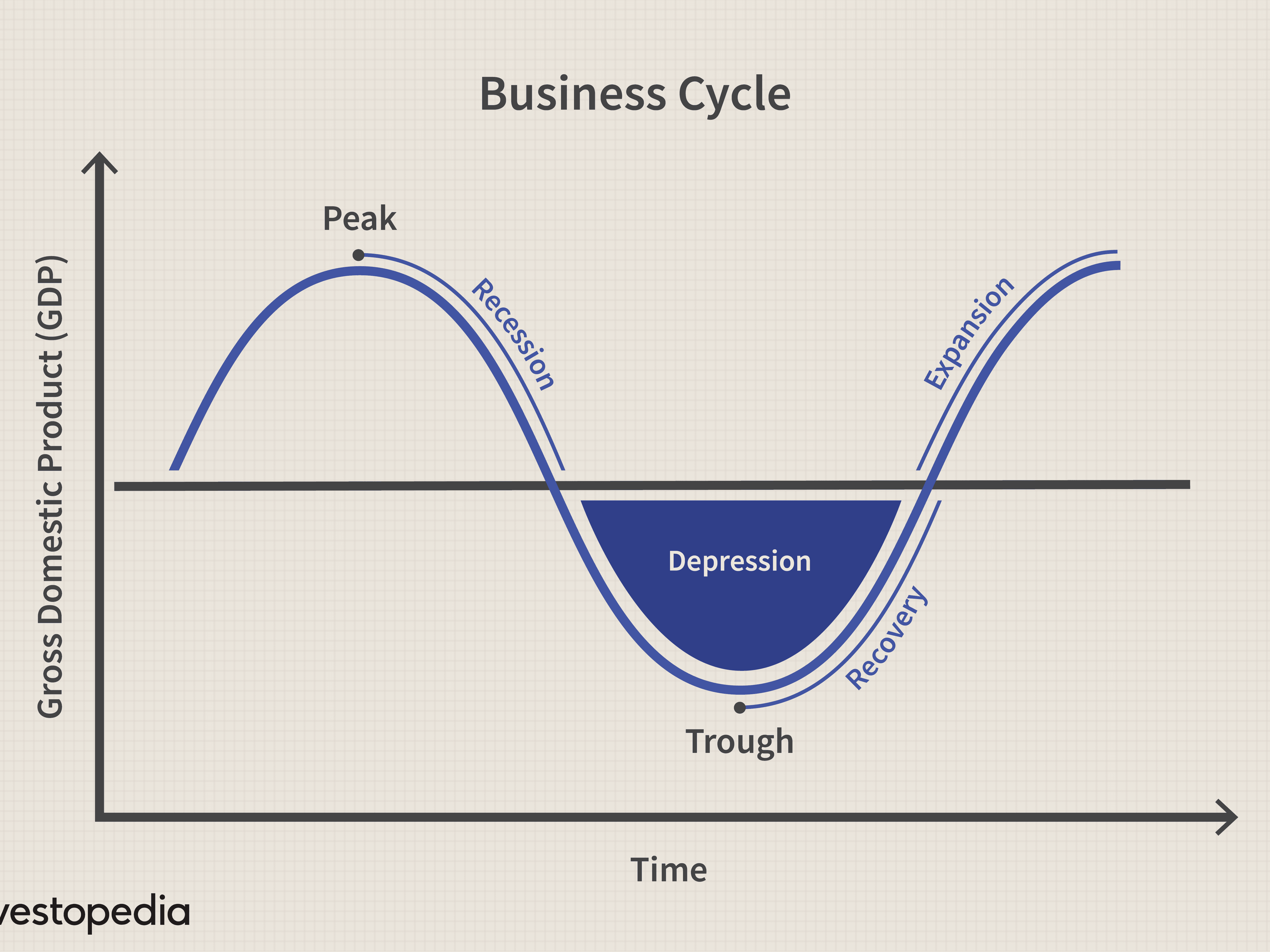

[Source](https://bilag.xxl.no/read/draw-and-label-the-business-cycle.html)

[Source](https://bilag.xxl.no/read/draw-and-label-the-business-cycle.html)