MARKETS ALL OVER THE PLACE

The market has been on an upward trajectory since the beginning of the previous week, with the S&P rising by +1.48%

This was mainly due to Trump’s statements that he will be more lenient with the tariffs set to begin on April 2nd

The Magnificent 7 have made a strong comeback, somewhat easing last month’s losses.

A few moments later

MARKETS IN FREEFALL

We saw a significant drop in the markets on Friday, with the S&P falling by 2% and the Nasdaq by 2.6%

And yes, this decline started on Wednesday night with Trump’s new tariffs

However, Friday's drop was triggered by inflation and consumer confidence

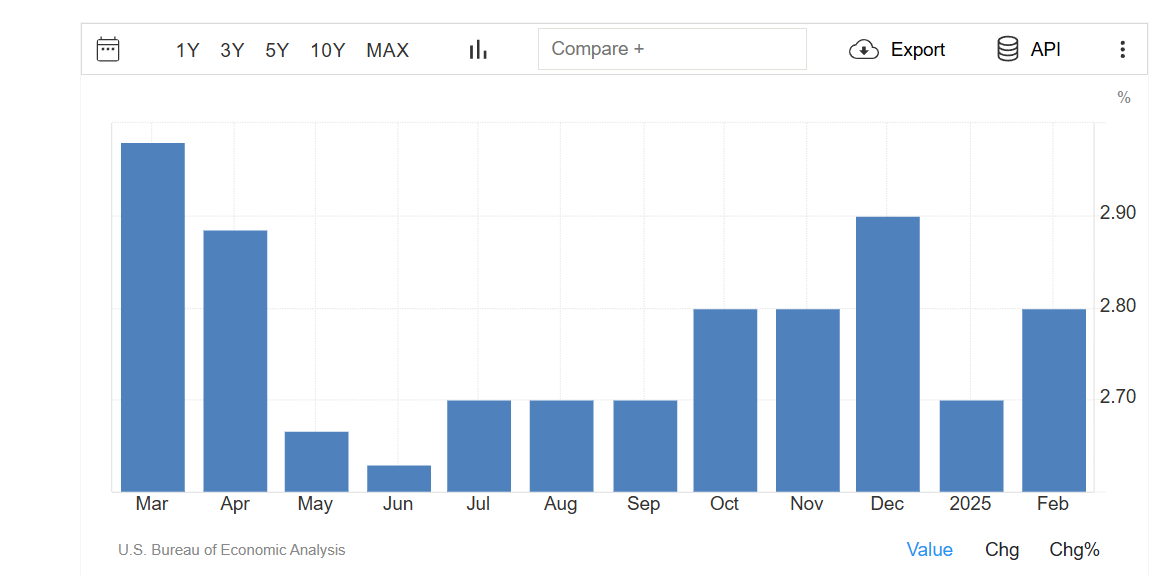

A. The core PCE came in at 2.8%, while expectations were at 2.7%

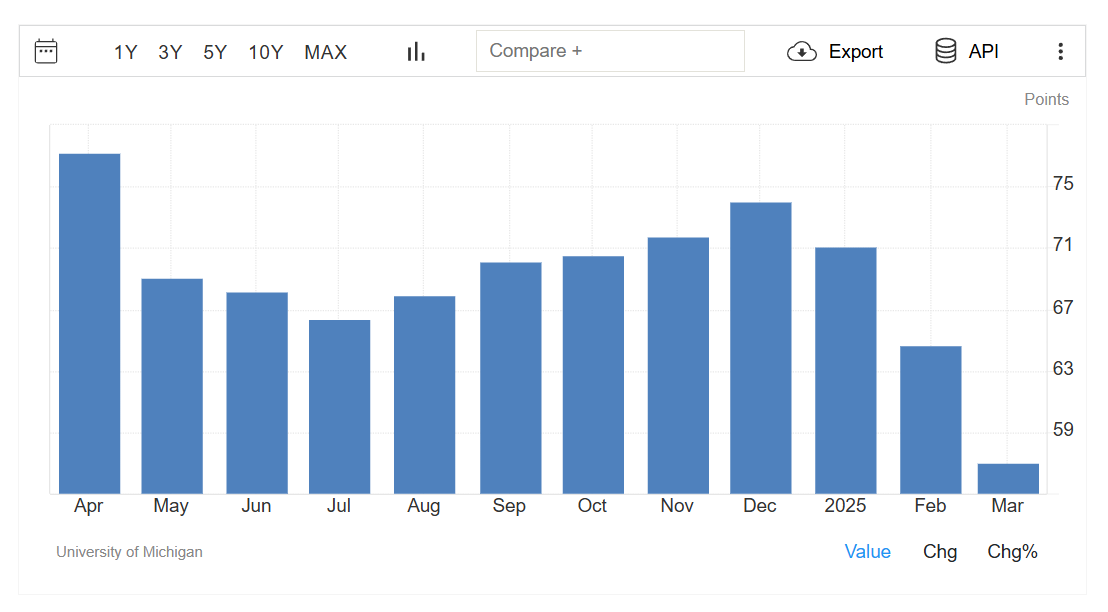

B. Consumer confidence dropped to just 57 – the lowest level we've seen since 2022

In other words, investors are worried about both inflation and the consumer’s wallet

That said, we saw some high-quality stocks trading at much better prices after a long time.

WHAT'S GOING ON WITH TESLA?

Throughout March, many stocks have seen significant declines from their all-time highs

But the one that seems to be suffering the most is Tesla, which is down -31.4% YTD

On Friday, we saw that the short interest in Tesla (the percentage of shares that have been shorted) stands at 2.1%, meaning 81 million shares are being bet against

Short sellers have already made $10 billion since the beginning of the year

As you can imagine, there’s massive pessimism surrounding the stock

A large part of this negativity is tied directly to CEO Elon Musk’s antics

But the company’s fundamentals aren’t helping either, with revenue growth stalling and profit margins shrinking

Of course, this isn’t the first time Tesla has gone through such a rough patch. It has faced worse before, and the stock has skyrocketed

What’s your investment outlook on Tesla?