Yesterday, the April inflation numbers were released, and... things are better than expected!

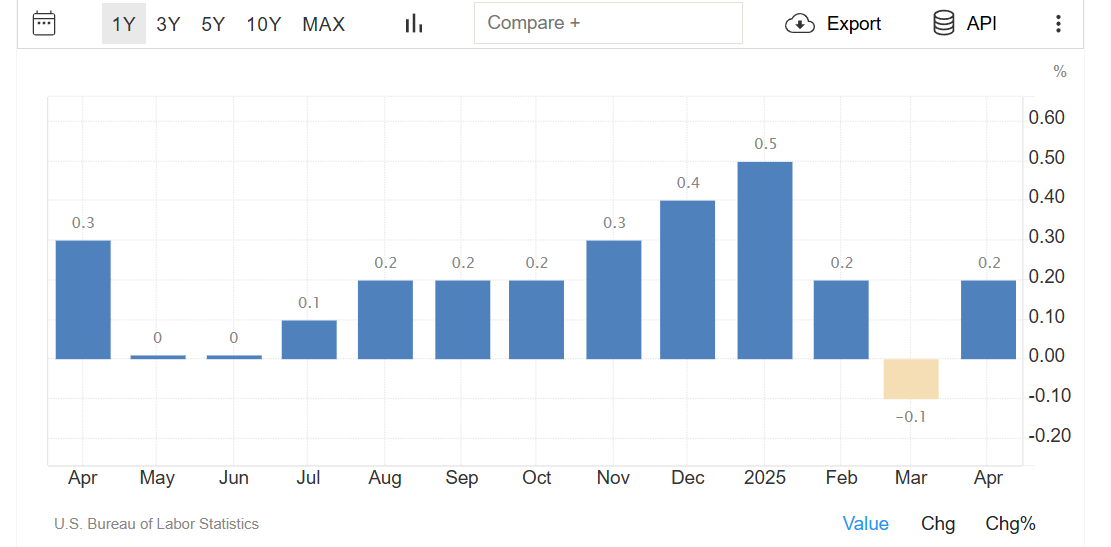

The Consumer Price Index (CPI) came in at 0.2% in April, while analysts were expecting 0.3%. It might sound like a small difference, but in the world of investing... these numbers make all the difference! After all, forecasts heavily influence investor decisions, the Federal Reserve's moves, and overall market sentiment.

And this comes after prices had decreased in March, so now we're seeing a small but CONTROLLED increase. This means that not only are we avoiding a sudden spike, but we're also staying within levels that allow the economy to breathe, while the risks of runaway inflation remain limited.

At least for now...

INFLATION

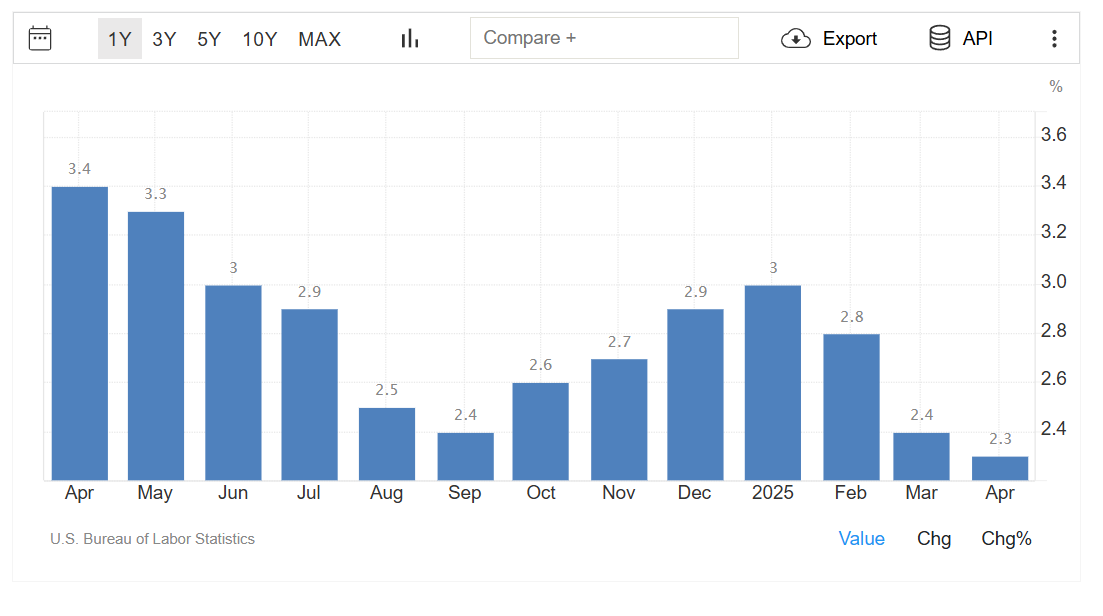

According to data from the Bureau of Labor Statistics, annual inflation reached 2.3%, slightly below the forecast of 2.4%.

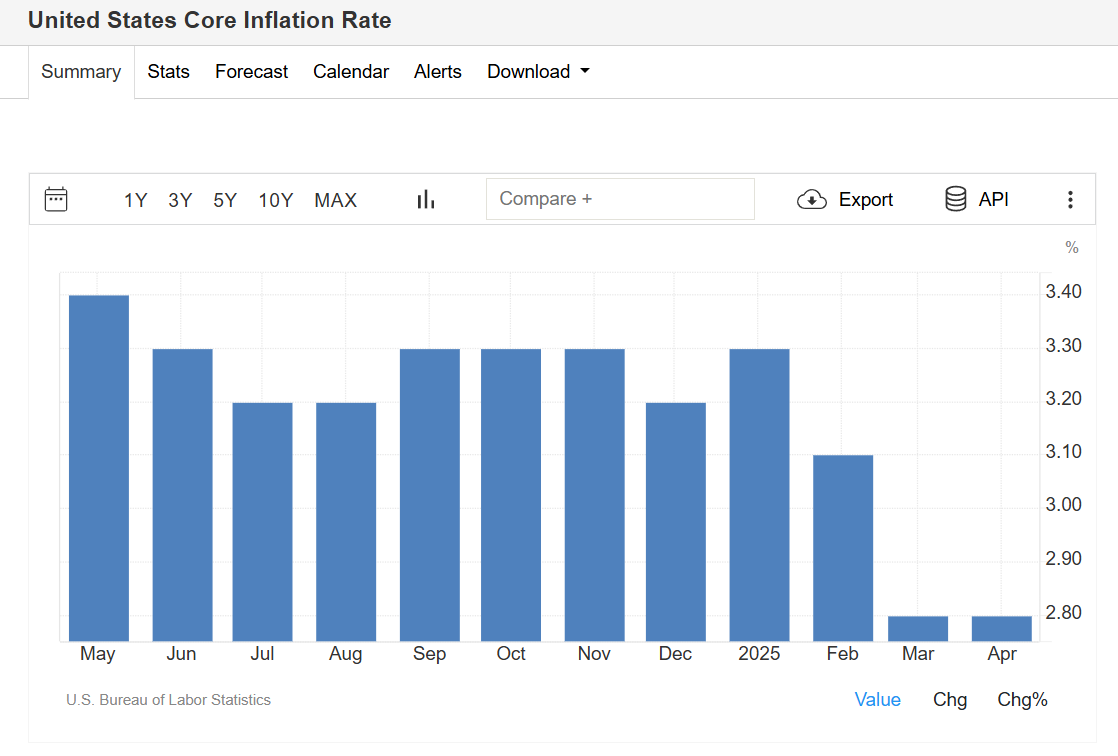

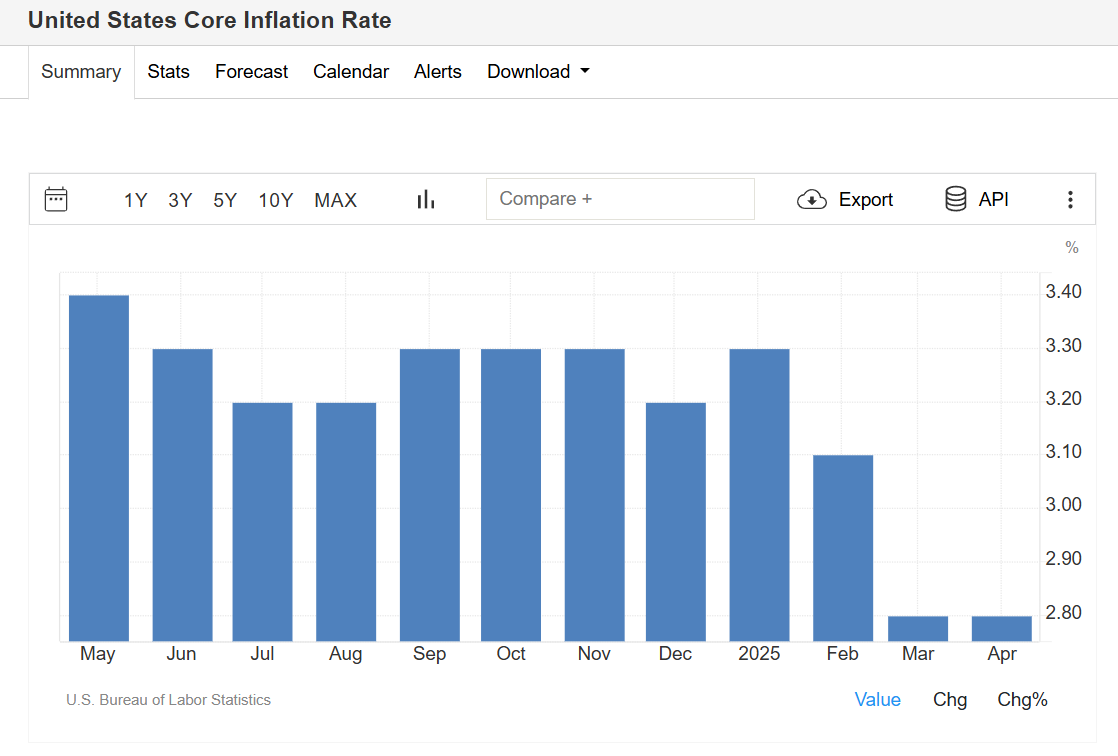

Similarly, the Core CPI (excluding food and energy) rose by 0.2% for the month, with the annual rate holding steady at 2.8%.

This stability is particularly important because it shows that inflation isn't spiraling out of control, while the overall economic picture remains steady.

WHAT CAUSED THIS SLIGHT INCREASE?

Primarily, it was driven by housing (+0.3%), with energy prices also climbing (+0.7%). On the other hand, sectors like clothing, used cars, and airline tickets saw price declines. This indicates that there are still segments acting as a "buffer" against broader price increases.

AND THE MOST IMPORTANT PART?

Analysts still don't see the impact of the new tariffs announced earlier in April. This means that the "wave" of cost increases might come later in 2025, as current inventory stocks—imported before the tariffs—run out. This is crucial for businesses, which will have to decide whether to absorb these costs or pass them on to consumers.

WHAT DOES THIS MEAN FOR THE FED?

For now, this report doesn't dramatically change the Fed's stance. It doesn't provide a strong case for raising interest rates, but it also keeps the door open for possible CUTS in the near future. And that's the big bet for markets in the second half of 2025.

The market seems to be holding its breath—investors, businesses, and consumers alike. As one analyst put it, "uncertainty is worse than overheating." And as long as we don't have a clear picture of the Fed's intentions, market nervousness will linger.

The bottom line is that in the short term, inflation appears to be under control. If this trend continues and we don't see a price surge from tariffs, the Fed might consider cutting rates to boost growth.

I believe that the important numbers that will reflect all this trade war will start reflecting after July