Welcome to The Daily Leo! We pull the best articles in Finance, Crypto news, and Hive/Leo into one condensed information-packed space. Be sure to follow @thedailyleo so you never miss the Daily LEO. You can also subscribe to the newsletter here Subscribe to the Daily LEO

Solana, once dominant in stablecoin transaction volumes and known as a memecoin hub, is facing a sharp decline. After peaking in January 2025 with $1.75 trillion in stablecoin volume, it saw an 83.87% crash to $282 billion in February.

Despite leading in 2024 with $11.37 trillion settled, surpassing Ethereum, the memecoin frenzy—sparked by Trump’s coin launch—appears to be fading. With users exiting and no strong use case beyond speculative tokens, Solana may be entering a slow decline without renewed momentum.

This post is about the growing trend of U.S. states establishing cryptocurrency reserves, signaling a major shift in how governments may handle digital assets. New Hampshire and Arizona led the way—New Hampshire by capping allocations to digital assets, and Arizona by using unclaimed property to fund its reserve. These moves follow President Trump’s creation of a national Bitcoin reserve and hint at broader state-level adoption.

Texas is seen as a strong contender to follow. With Bitcoin surpassing $100K again and institutional interest rising, crypto reserves are becoming a strategic play in government finance—not just a speculative gamble.

This post is about Bitcoin’s surge back to $102,912, driven by strong institutional interest and ETF inflows totaling $867 million last week. Bitcoin has risen 10.9% in a week and 25.1% since early May.

Institutional focus remains heavily on Bitcoin, with U.S.-listed BTC ETFs hitting $62.9 billion in net revenue. In contrast, Ethereum ETFs saw minimal inflows, while SUI and Solana recorded more notable activity, hinting at potential approval of new ETFs soon.

—-

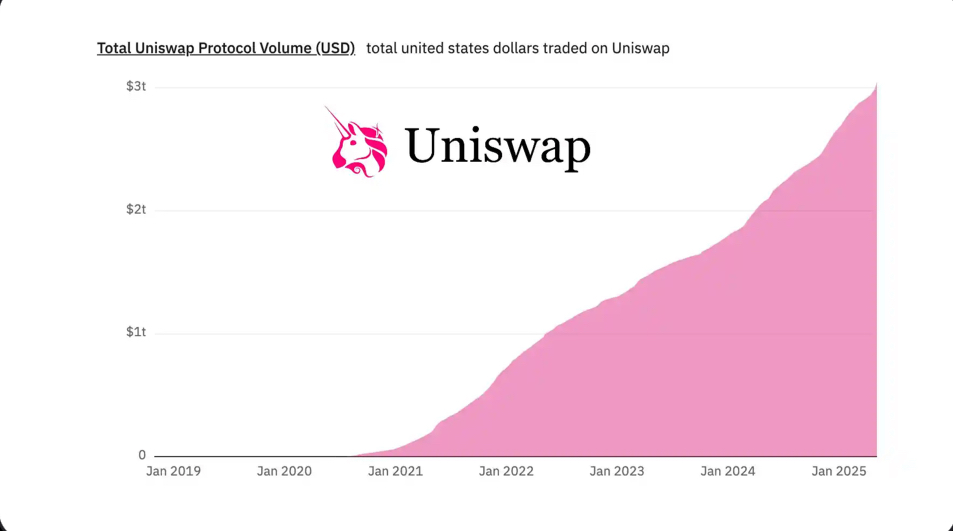

Uniswap has become the first decentralized exchange (DEX) to surpass $3 trillion in cumulative trading volume since its 2018 launch. This milestone reflects its rapid growth, multi-chain expansion, and innovation like Uniswap v4 and Unichain.

Despite strong performance and a 23% DEX market share, its UNI token remains 84% below its all-time high. With cutting-edge features and continued development, Uniswap aims to reach $10 trillion in volume, cementing its DeFi leadership.