noooooooo

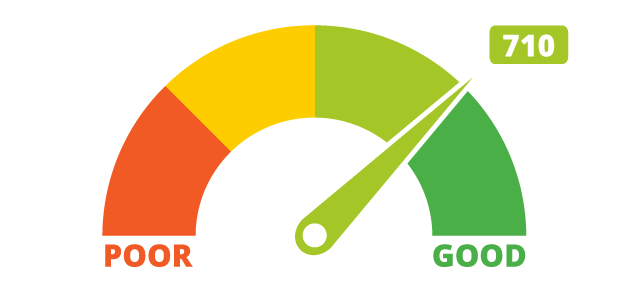

So I got a flood of alarming emails last week telling me there were changes to my credit score. There were so many alerts I thought I was the victim of identity theft and someone was taking out debt in my name or something. But alas, I was in fact a victim of my own circumstances. This web of debt was of my own making!

Trump admin strikes again!

Remember how the Biden admin told everyone they were going to forgive student debt and that really pissed off the right? Ah well, you might be able to guess where this is going. I'm already on record in my decision to never pay off my student loans, and the chickens have come home to roost. Boy Howdy.

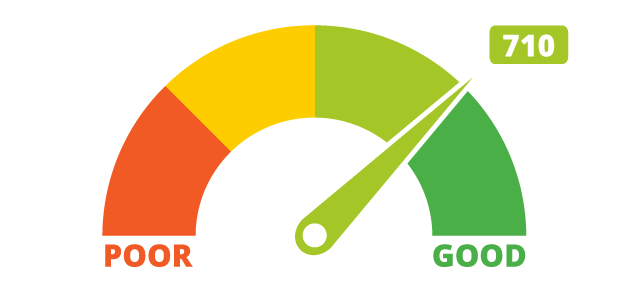

I must admit I was a little surprised to see my credit score tank from all time highs around ~720 to back to the gutter at the 500 level in a single day. This reminded me of the good ol days when I maxed out all my credit cards and just decided I wasn't going to pay any of that money back... in fact now that my credit score is already nuked back to bedrock levels I have a unique opportunity in that I could do it all over again... I could max out all my credit cards once again and just steal the money and never pay it back... thinking about it but I don't think I'm going to pull that move on purpose in true opportunist fashion... even though it's very tempting and I could squeeze like $7000 out of the credit card companies.

The reason I don't want to send my credit cards to collections is two fold. First of all it's a bit shady to pull a move like that with deliberate intent. The last time was out of necessity because I quite simply could not pay, and by the time I could it was no longer worth doing so. Even though I have no respect for the establishment or the institutions that run it I still have an intact sense of personal honor.

The second reason why I don't want to nuke my credit cards is... I like having credit cards. Credit cards are awesome, and it will undoubtedly be a lot easier to build my credit score back in the wake of these delinquent student loan accounts if I keep them around and in good standing. I won't be able to take on more debt in the short or mid term... but I'm also not looking to take on more debt.

My girlfriend and I had plans to maybe buy a new car or a house sometime in the future and this event could definitely muck up those plans pretty badly, but hell if crypto moons like I think it will I'll just be able to buy anything I want outright and won't have to take a loan from a bank in the first place.

Crypto as collateral.

Pulling on this thread a little more, it won't be long before the banks allow you to buy things with Bitcoin collateral without creating the tax event of selling the Bitcoin. Want to buy a house but don't want to sell the corn? Easy, just give the bank your Bitcoin as collateral. Now the loan they give you is extremely safe, as there are two forms of collateral (the house and the Bitcoin). As the Bitcoin appreciates in value (think of it as the down payment) it can exceed the value of the house, in which case it could be liquidated to pay off the loan... or the bank could do whatever they wanted with it.

It's stuff like this that doesn't exist yet but definitely will within the next decade as we enter into the mainstream adoption phase. It's also a big reason why governments don't want cryptocurrency to be legally classified as a currency... because if you buy a house with currency they can't tax spending the currency like they could with other legal forms of ownership like commodities, stonks, and property.

Next steps

I've done a lot of research over the years on securities, taxes, regulations, and most relevantly: debt/bankruptcy. It turns out that taking a loan from the government is a lot more risky to the individual than taking it from an institution like a bank. Government loans come with way more strings attached, and they can try to pull stuff like garnishing your wages or taking your house to claw back the debt you owe them. "Lucky" for me I don't have wages... or a house... or a car. I literally don't own anything of value they can take from me by force without my approval. So we'll see how that works out. I'm also quite unconvinced they know I own a good chunk of crypto but maybe I'm wrong.

Again, I'm surprised this is happening now because I haven't made payments on my student loans for over a decade (and at one point I thought they had been forgiven already). I would always just log into the website... let's see who owns/services this debt these days... the credit alert says it's managed through a company called AidVantage... which is different than when I first got the loan from Navient.

It's for reasons like this that I think it's going to be very legally dubious for the government to clawback this debt. They've transferred this debt to other companies two or perhaps even three times now. During COVID 2020 they put me on automatic deferment... which I never actually approved. So I literally haven't even been legally agreeing to pay back this debt for 5 years. This was the main reason I was hoping I'd never be in this situation in the first place, but obviously Trump admin don't give a fuck so it is what it is.

Best case scenario

My accounts are currently "deliquent" (unpaid for 90 days) which is the extreme danger zone when it comes to government debt. What I need is for the Department of Education to sell this debt to a collection agency at auction. Once that happens I can no longer be sued in court for the money and I'm basically in the clear. I can then ignore the collection agency or chat them up from time to time and tell them I'm willing to pay them back pennies on the dollar just to clear the debt and get my credit score back. Otherwise I might have to wait something like 4 years until after the debt is sold to collections for it to drop off my not-so permanent record.

Thinking about this in depth is funny because isn't Trump's goal to dismantle the Department of Education? How are you going to clawback this debt when you're defunding the very institution that is owed the debt? Hilarious. This is going to be fun journey for me I can tell.

How much do I even owe?

To be honest I have no idea how much I owe to the government... it's been so long since I've even checked but my guess would be low five figures in the range of $20k-$30k. However these credit score reports will tell me the exact numbers... which I will round/combine in weird ways to maintain privacy.

Credit score delinquent alerts:

- $4000

- $5000

- $3100

- $7200

- $2700

$22k

If I'm being honest this is a little less than I thought it would be... especially after a decade of unabated interest rates (although my rates were pretty low IIRC like 3%-5% maybe). Most people were not that lucky with their student loans. I don't know how I did it but I was able to leverage this money (plus Pell Grants and such) for years and years in college while I basically fucked off and played World of Warcraft the entire time. Such a good use of time and money :D

Conclusion

I'm not paying the gubment back; they can suck rocks. At this point it's the principal of the thing. Any opportunity to not pay our corrupt government money... ah well I have to take it at this point. It is what it is, even if I'm a millionaire next month I'm not paying this garbage. Too much history; too much bullshit. Now was as good a time as any to deal with this situation. Expect updates as the situations escalates (or deescalates as the case may be).