Jupiter has emerged as the shiny new start in the DeFi ecosystem on Solana. It’s not exactly a classical DEX as Uniswap, but it’s more as a DEX aggregator pulling liquidity from different apps and DEXs. It is integrating different aspects of DeFi and at the same time building some features of its own like individual pools etc.

The Jupiter app had a form of soft launch back in the summer of 2023, while it really took off in January 2024 with the launch of its native token JUP. There was an airdrop for the token as well.

Here we will be looking at:

- Trading volume

- Total value locked

- Number of users

- Top exchanges

- Top Pairs and pool providers

- Price

The data is taken from places like the official Jupiter stats, Defi Lama, Dune Analytics, Coingecko etc.

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

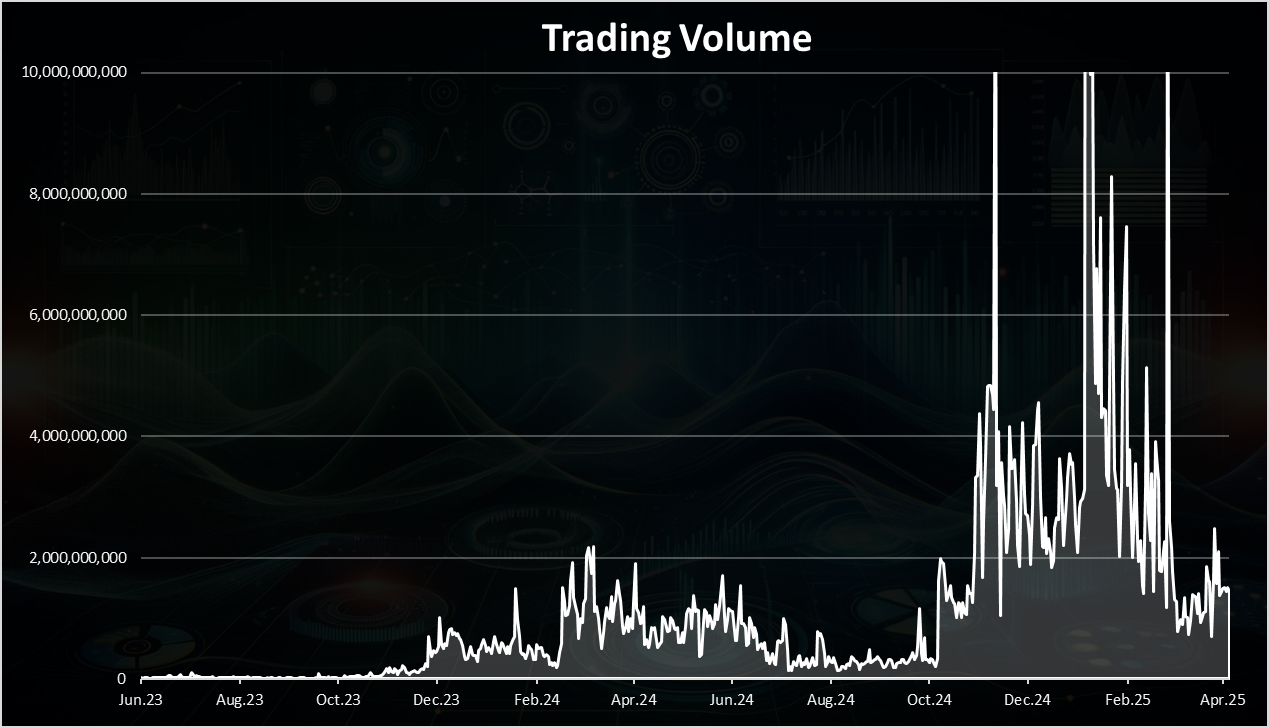

The chart for the trading volume looks like this.

This is a chart for the daily trading volume. It’s quite volatile.

Prior to December 2023 the trading volume was quite low on Jupiter and then it increased a lot in December reaching one billion per day. A small pull back and a growth again in March 2024 up to 2B daily.

The volume really took off in Q4 of the last year, when there was a lot of tokens launching on the Solana blockchain and a lot of trading happening trough Jupiter. On a few occasions there was more than 10B daily volume. A pull back in 2025 and we are now around 2B daily trading volume on Jupiter.

Quite an impressive year for Jupiter.

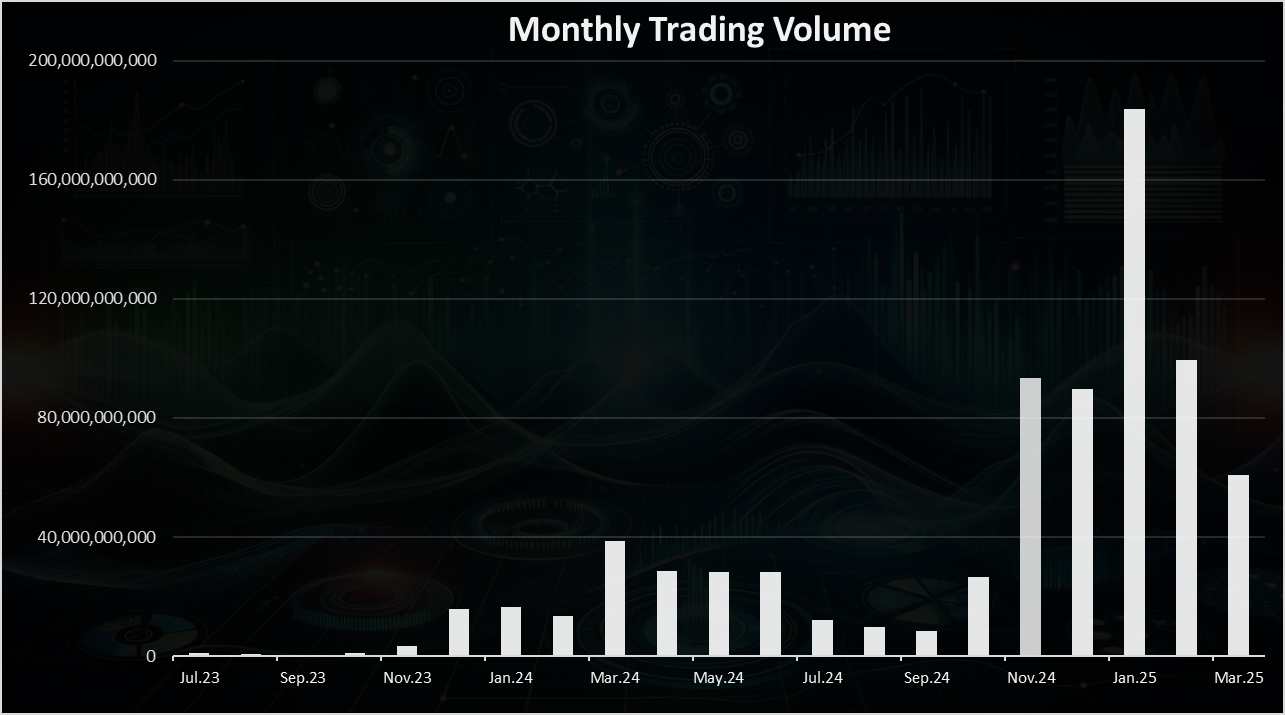

On a monthly basis the chart looks like this:

Here we can notice the massive increase in November 2024 going, reaching an ATH in January 2025 and a pull back in March 2025, but still higher than it was then before.

January 2025 had a massive 180B in trading volume. March 2025 is around 60B in trading volume.

Total Value Locked

Here is the chart for the TVL on Jupiter

When it comes to Jupiter the TVL is sort of side metric since it doesn’t include the pools that it integrates from other protocols.

It has some own liquidity though and as we can see it is at 2B now.

Active Users

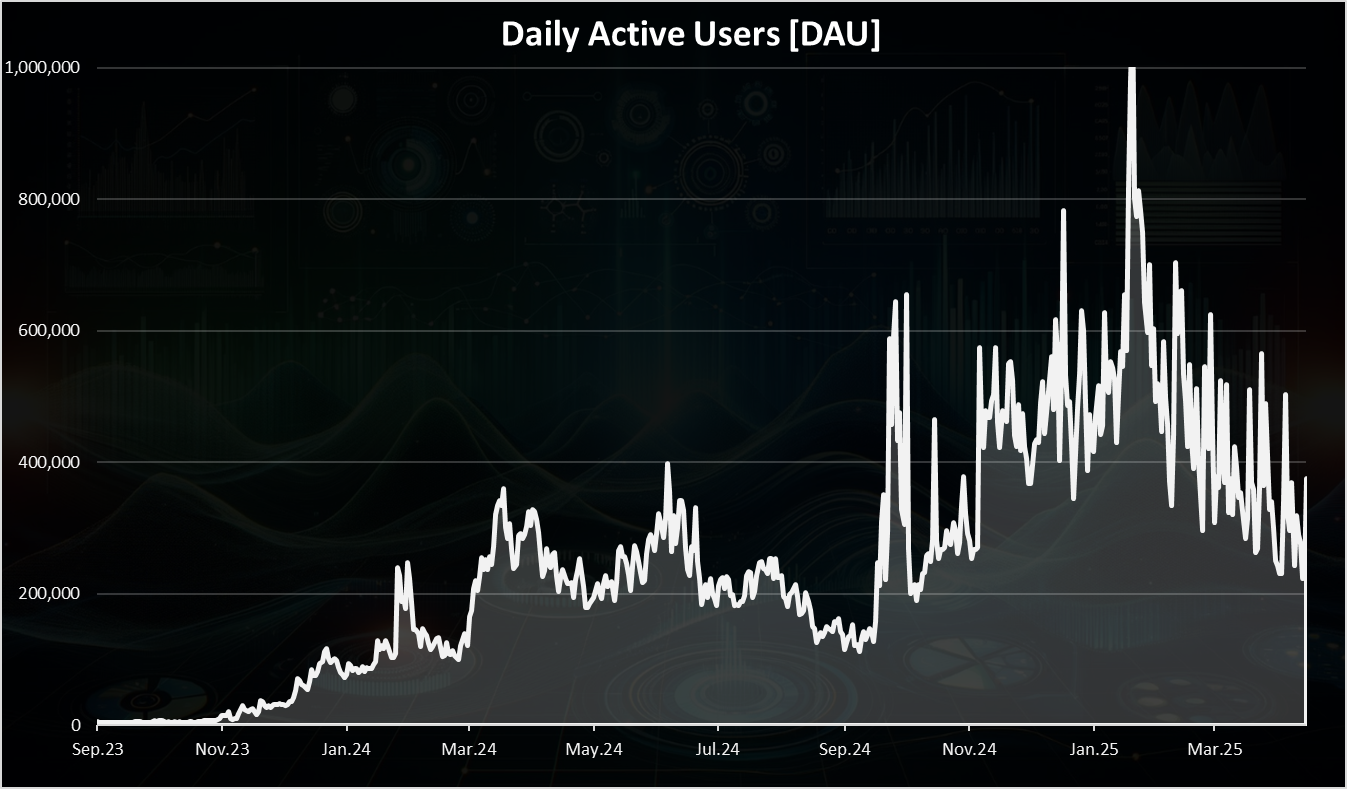

How many users does Uniswap have? Here is the chart.

A constant growth in terms of active accounts here up to January 2025 and a pull back since then. At the top there was more than 1M daily that is quite amazing.

Probably there is a lot of bots, but still quite the numbers.

In the last period, the numbers are in the range around 300k DAUs.

Top Exchanges

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like Coingecko the numbers looks like this.

This ranking combines both, CEXs (centralized exchanges) and DEXs.

We can see that Jupiter is now in the top 10 exchanges in the world by trading volume that is quite an achievement having in mind the short period of time it has been operating in. It has close to 2B daily trading volume.

There are few more DEXs that are in the top exchanges like Uniswap and Raydium, another Solana exchange.

Top Trading Pairs on Jupiter

Here is the chart for the top trading pairs ranked by liquidity.

The USDC-SOL is in the first spot here with close to 7B trading volume in the last week.

After this trading pair there is a sharp drop to around 1.5B where it is the stablecoin pair USDC-USDT, followed by a memecoin Fartcoin.

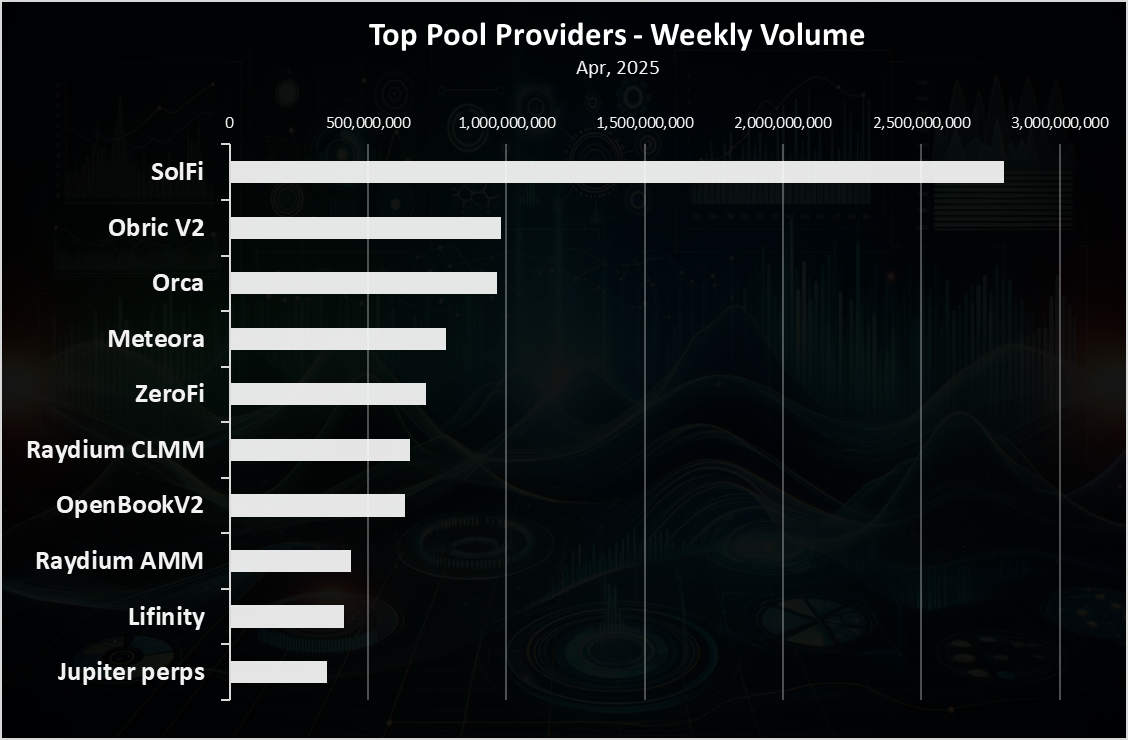

In terms of liquidity pools providers the chart looks like this:

The SolFi DEX is on the top followed by Orca and then Meteora. Jupiter aggregates all the pools from this exchanges providing users a great experience.

Price

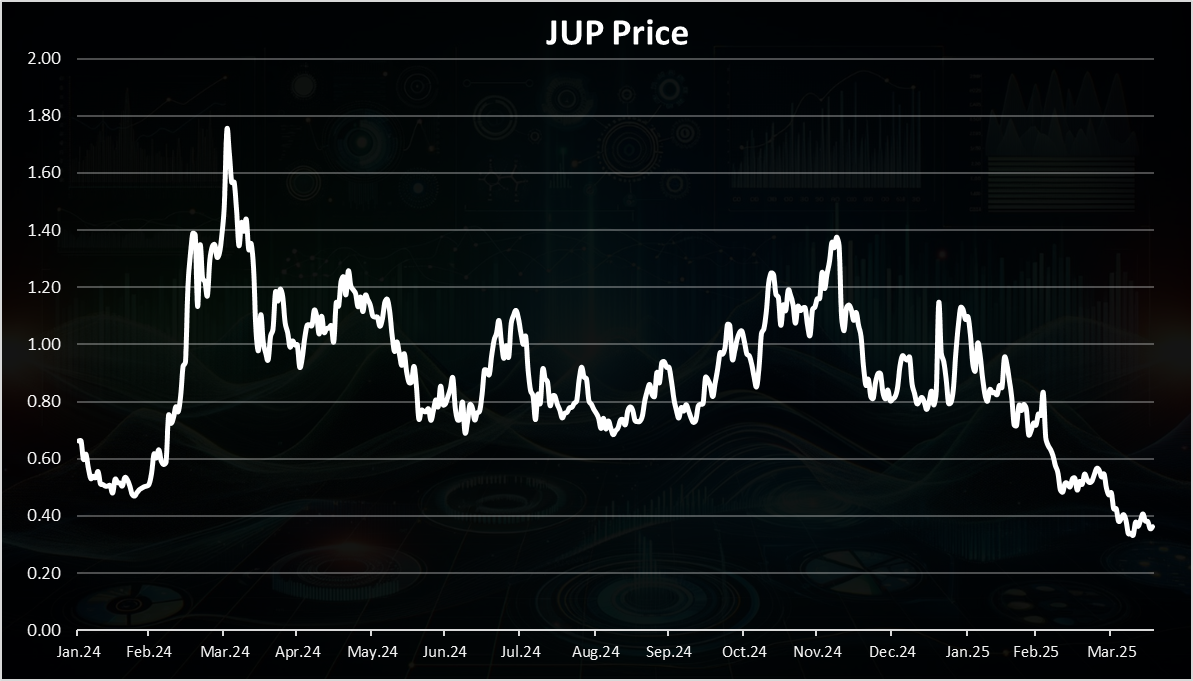

The chart for the JUP price looks like this.

As mentioned JUP is newly launched token starting from January 2024. It started trading around 0.6, then increased to 1.6 USD dropped and sort of stabilized around the dollar mark in 2024

Starting from 2025 it started going down and now it is at its all time low around the 40 cents mark.