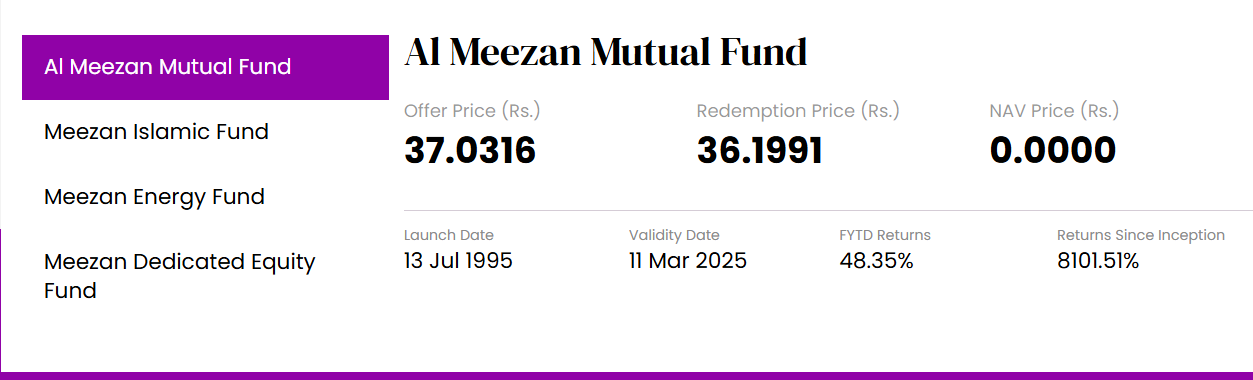

Al Meezan investment has many investment opportunities, recently I have decided that I will invest in some funds and try out some of its products. Al Meezan Investment is Pakistan's largest investment market where 21 funds are available for investment which depends upon the nature of investor which one to select.

Any investor can make their investment through this market. If you open Al-Meezan investment, you will see 21 products available, which are in different categories and risk profiles. Out of 21 funds any of the fund will be suitable for the investor to choose.

The minimum investment limit allowed is MCF, which is known as Meezan Cash Fund. Here, you can initially invest 5000 PKR, which is equivalent to $16.

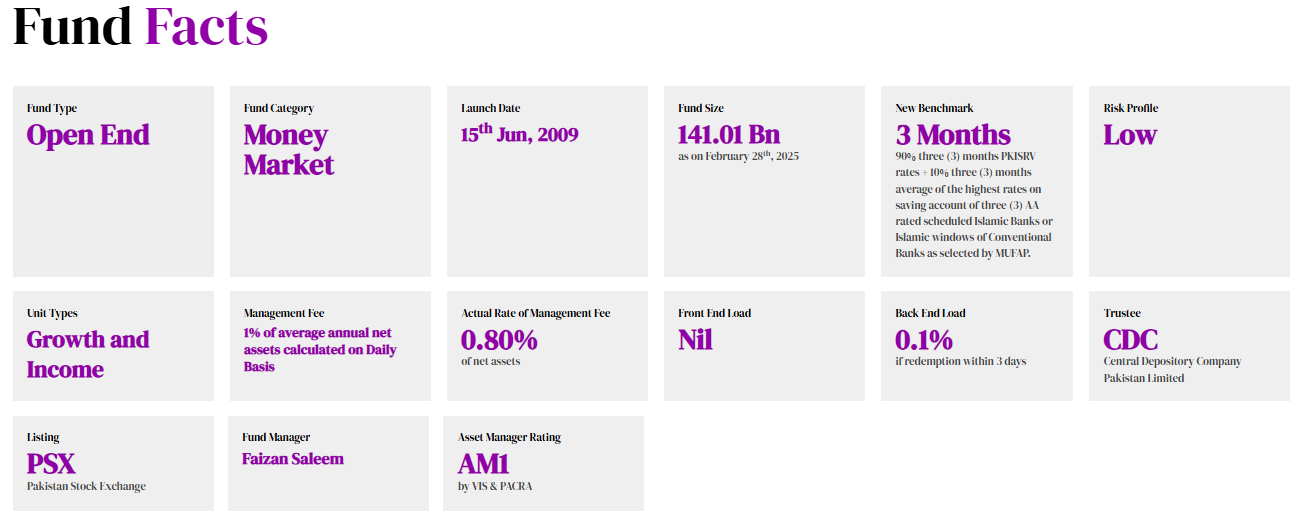

Similarly, each product has its own criteria, which totally depends on the investor. Some products have a minimum investment of 5000, while others may require a minimum of 500,000, and if we talk about the risk profile, there are three types: High, moderate, and low risk. Again, it will depend on the investor which one they choose.

One thing to keep in mind is that the higher the risk, the higher the return. Similarly, if the risk is low, the return will also be low. Therefore, every investor should choose a product according to their risk tolerance, and it is also better to choose a product that you have knowledge or information about.

I want to start investing in Al-Meezan, and I was thinking about which fund to choose for investment. For this, I spent a week gathering information and understanding this market well.

What I understood, I will also share with you all. Anyone can invest in Al Meezan, whether they are Pakistani or from outside the country. Any investor is welcome in this market.

Four funds seemed very good to me, and I will try to provide details about them. First of all, for those who do not want to take low risk, they can invest in Meezan Cash Fund or Meezan Rozana Amdani Fund, which have a low-risk profile and a minimum investment of 5000 PKR.

In this fund, you will receive profit daily, which will be at an 18% APR rate. Also, in June, you will receive dividends, which will depend on the amount of your investment. This fund has no entry or exit load, which is the best option for investors.

After this, there is the Meezan Dividend Yield Fund, which falls under the high-risk category. This is a fund where your money will be invested in dividend shares, and you will keep receiving APR profits accordingly. In 2024, investors earned a profit of 76% APR. This fund has a 2% entry and exit load, which needs to be paid on the capital amount.

Next is the Meezan Gold Fund, which is the best option in high-risk. If an investor wants their money invested in gold, they would invest in this fund. The best benefit of this is that you don’t have to buy gold and worry about its security, but you can buy gold online.

For example, the price of gold per tola is $300, so you can buy gold in the same amount as your total investment. For example, if you want to buy 1 tola of gold, you will need to deposit that amount. This is high risk, as it totally depends on the price of gold.

If the price of gold goes up, you will make a profit, and if the price goes down, you will incur a loss. This has a 2% entry and exit load, which needs to be paid based on the total capital.

These are some of the funds that are excellent for investment and will definitely help in long-term wealth growth. There are also many other funds that you will see on their website, but these are some funds that are safer and more suitable for investors. I hope the post is informative.

I hope you find this post interesting and I hope you will like it. If you like the post, please leave feedback in the comments section so that the next one will be even better. Thank you for sticking with me until the end.

TWITTER TELEGRAM HIVE WHATSAPP DISCORD

IMAGES AND GIF TAKEN FROM CANVA, EDITED IN CANVA

IMAGE SOURCE

REMEMBER: We should prepare for the unexpected and hope for the best. Life may not be easy, but you must do your best and leave the rest to God.